Why People Choose Us

Our services have been introduced in

about 40% of the listed companies and their affiliates

We are steadily increasing our achievements by leveraging our database of more than 5.4 million companies, which is one of the largest in Japan,

and our unique know-how on examinations, as well as the overwhelming speed and

low cost made by utilizing the Internet. The credit management service is used by 7,498 corporate members (as of March 2024). Of these, we have a

track record of approximately 40% listed companies and their

affiliated companies introducing our services. It is also being actively introduced by growing companies aiming to go public in order to establish

their

risk management system.

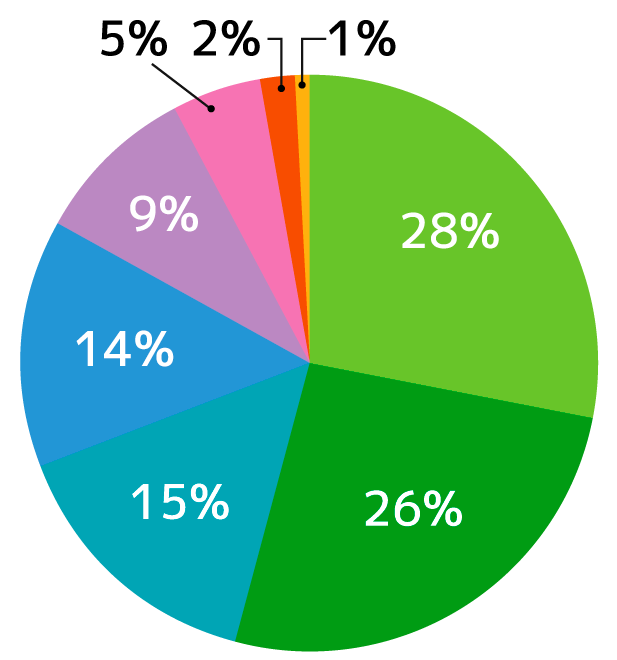

- Wholesale, retail

- Manufacturing industry

- Construction/real estate related business

- Service industry

- Information and communication industry

- Transportation related business

- Financial industry

- Other

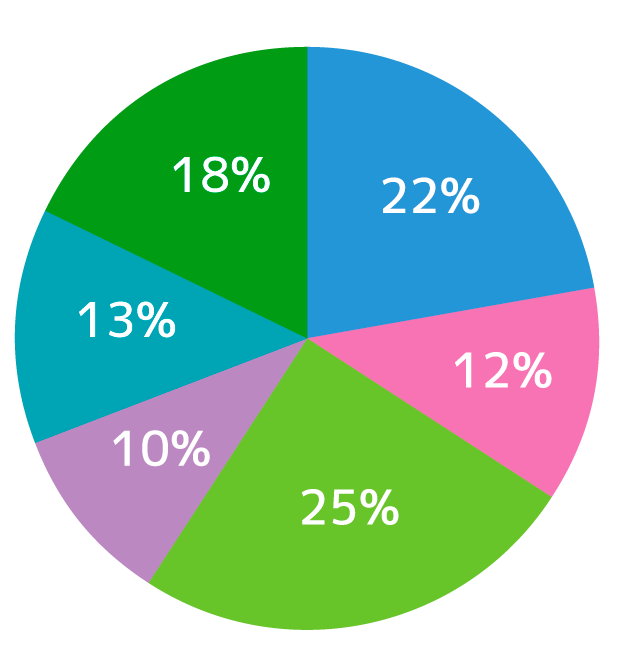

- Less than 0.5 billion yen

- More than 0.5 billion yen and less than 1 billion yen

- More than 1 billion yen and less than 5 billion yen

- More than 5 billion yen and less than 10 billion yen

- More than 10 billion yen and less than 30 billion yen

- 30 billion yen or more

Reason 1We provide clear and easy-to-understand credit information.

RiskMonster was founded by a person from the examination department of a major trading company. The data provided daily by more than 30 information institutions are stored in our one-of-the-largest-in-Japan corporate databases and are constantly updated by exchanging data. Based on the

accumulated data, our analysts make them into clear and easy-to-understand data on bankrupted

companies. Credit management tends to depend on subjective judgments based on experience and

intuition, but we make it possible for you to verify how likely a business partner is to go bankrupt

with clear criteria. Regarding the calculation of the credit limit, we provide safe credit limits for you to avoid all risks by analyzing both your own management status and the creditworthiness of the

business partner.

Reason 2Our support on your credit management operation reduces costs and labor.

If you do not assign dedicated personnel for credit management, you can still establish an internal

management system based on clear criteria. In addition, you can check the status of your credit risk

management by Portfolio Analysis, a consulting service. We also offer advice for improvements.

By letting us undertake the services, you can reduce the cost and labor required for credit research

and improve your work efficiency.

Reason 3We provide highly accurate corporate ratings.

We analyze the data accumulated in our one-of-the-largest-in-Japan databases daily and reflect them into our unique corporate ratings. We are proud of the high

accuracy that more than 90% of bankrupted companies were the lower ranked companies. We improve the accuracy of your credit management operation with the

indicators backed by bankruptcy records.

RM Rating

The RM rating is our unique credit management index backed by the

bankruptcy records. It ranks companies in six levels of A, B, C, D, E, and F

(nine levels when including subdivisions). One of the major features of the

RM Rating is that analysts continue to make corrections on them by

collecting and analyzing daily credit information, in addition to making

changes by regularly updating the data.

RM Credit Limit

We refer to the financial statements provided by the members and the

creditworthiness and scale of the business partners to calculate the amount of the credit limit that is safe for the business transactions from the

following three perspectives:

- Basic allowable amount for each rating according to your financial

strength - Maximum volume of sales in consideration of the business partner’s

share of your transactions - Maximum amount for approval according to your authority for providing approval.

We provide the minimum value among them as the RM Credit Limit.